How to get Freelancer Tax Incentive (2.5% to 10%) in Bangladesh

By Getlancers Editorial Team | Updated: January 2025

If you are a freelancer in Bangladesh earning in Dollars, Euros, or Pounds, you are not just earning for yourself—you are building the nation's foreign currency reserves. To reward this, the Government of Bangladesh offers a Cash Incentive on your earnings.

There is a lot of confusion in the market. Some say it's 10%, others say 4%, and banks often give 2.5%.

What is the truth for 2025?

-

Individual Freelancers: Automatically get 2.5% (Wage Earners' Incentive).

-

BASIS Member Companies: Can claim up to 6% to 10% (Export Subsidy) depending on specific criteria and audit reports.

This guide will show you how to structure your freelance business to claim the maximum incentive and file your taxes legally to keep 100% of your white money.

Step 1: The Basics (The 2.5% Auto-Bonus)

For most individual freelancers using platforms like Upwork, Fiverr, or Toptal, the process is now automated.

How to get it:

-

Bank Account: Open a designated "Freelancer Savings Account" or maintain a standard savings account at a bank that supports API remittance (e.g., City Bank, Brac Bank, Dutch-Bangla).

-

Remittance Channel: Bring the money via legal channels (Zoom, Payoneer to Bank, Wise to Bank). Do not use Hundi.

-

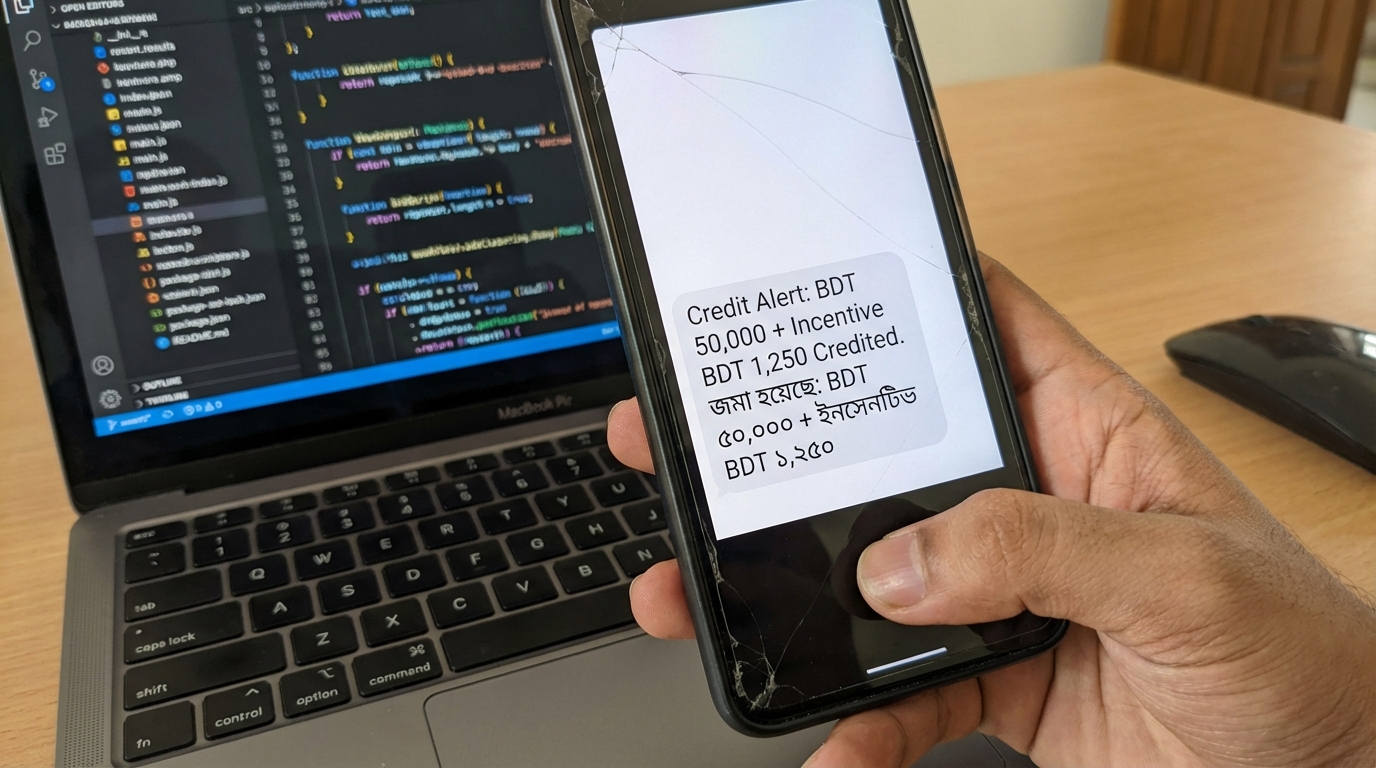

The Magic SMS: When the $1,000 hits your account, you should receive BDT equivalent + 2.5% extra instantly.

Pro Tip: If you send amounts over $5,000 (approx 5 Lakh BDT) in one go, the bank will pause the incentive and ask for documents (Job contract/Invoice). Keep your Upwork "Certificate of Earnings" ready.

Step 2: Going for Bigger Incentives (The BASIS Route)

If you are running an agency or earning significantly (e.g., $5k+ monthly), staying as an "Individual" leaves money on the table. Companies exporting IT services historically qualified for a 10% Cash Incentive (adjusted to ~6% in the recent FY24-25 circular).

To claim this, you need:

-

Trade License & TIN: Register as a Proprietorship or One Person Company (OPC).

-

BASIS Membership: Become a member of the Bangladesh Association of Software and Information Services.

-

PRC (Proceeds Realization Certificate): Your bank issues this to prove money entered BD.

-

Audit Report: A CA firm must certify your expenses and export earnings.

Is it worth it?

If you earn 1 Crore BDT a year, the difference between 2.5% and 6% is 3.5 Lakh BDT. That pays for your office rent!

Step 3: The "Tax Exemption" Certificate (Don't Pay 0% Tax without Proof)

Here is the biggest myth: "Freelancers don't have to pay tax."

Correction: Freelancing income is Tax-Exempt (until June 2025, pending extension), but you still must File a Return.

If you buy a car or flat later, the tax officer will ask: "Where did this money come from?"

If you say "Freelancing" but don't have the Tax Exemption Certificate, they will treat it as "Income from Other Sources" and tax you at regular rates (up to 25%!).

How to secure your 0% tax rate:

-

Tick the column for "Income from IT Enabled Services (ITES)".

-

Attach your bank certificate proving the money came as foreign remittance.

🛑 Need Help? Don't Fight the Bureaucracy Alone

Navigating BASIS audits, PRC issuance from lazy bank officials, and NBR tax files is a full-time job. You are a creator; don't waste time being an accountant.

Hire a Verified Expert on Getlancers:

| Professional | Service | Why Hire Them? |

| 1. TaxGenius BD | I will get your BASIS Membership & Trade License | Essential if you want to upgrade from 2.5% to 6% incentive. |

| 2. Mr. Anisur Rahman (CA) | I will audit your export earnings for Cash Incentive | Required for claiming the higher corporate incentive tiers. |

| 3. Advocate Farhana | I will get your Remittance Certificate from the Bank | Banks ignoring you? She gets the paper signed. |

| 4. Rahim Associates | I will file your Freelancer Zero Return | Ensures your income is legally classified as "Tax Exempt." |

| 5. Kamal Hossain (ITP) | I will fix your blocked remittance issues | Money stuck in "Compliance Hold"? He resolves it. |

Essential Documents Checklist 2025

To ensure you never face a "Compliance Hold" on your money:

-

[ ] Valid Passport (or NID).

-

[ ] Proof of Service: Upwork/Fiverr Profile Link or Client Contract.

-

[ ] Invoice: Generated for every withdrawal (FreshBooks or even a simple PDF).

-

[ ] Form C: For amounts over $10,000 (Bank handles this, just sign it).

Final Verdict

The "10% Incentive" is a goal you can reach by formalizing your business into an agency. But even if you stay as a solo freelancer, the 2.5% instant bonus + 0% Tax status is a massive win compared to other professions.

Just make sure you have the paper trail.

Write a Comment